So much has changed with credit scores in the past few years. They’ve gone from simply monitoring how much debt we have to impacting nearly every aspect of our financial lives.

So much has changed with credit scores in the past few years. They’ve gone from simply monitoring how much debt we have to impacting nearly every aspect of our financial lives.

Credit scoring has been criticized for its complexity, for supposedly encouraging more debt, and for failing to reward those who pay with cash; nevertheless, it is a reality in today’s complex economy, and should be taken seriously. Here are six common myths that cost consumers thousands of dollars every year because they simply fail to understand them. Be sure to share this with family and friends.

#1. My score doesn’t matter if I pay cash for everything — While this may have once been — and probably should be — true, this myth is no longer applicable. Your credit score can play a significant part in determining the cost or ability to do any of the following:

Rent an apartment or home

Rent an apartment or home- Get a job or promotion

- Buy or lease a car

- Work in the military, law enforcement, TSA, accounting, banking, temporary positions, etc.

- Purchase auto, home, or life insurance

- Obtain a security clearance

- Switch cell phone plans

- Buy a home

- Secure an emergency credit card

- Qualify for some student loans

- Enter a long-term relationship

- Select your preferred retirement rental

- Gain acceptance into an assisted living program or facility

- Sign up for utilities

Adults in their 40s and 50s now find themselves having to co-sign for loans, utilities, cellphone accounts, and apartments for both young adult children as well as aging parents who were told their scores didn’t matter.

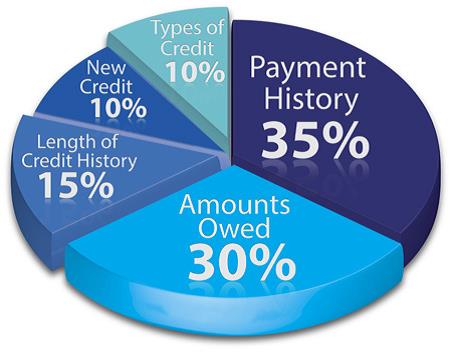

#2. It’s good to cut up my credit cards — This old technique was once encouraged, but can actually hurt your credit score today. Reducing debt, limiting new charges, and closing an excessive amount of credit accounts are all positive money-management strategies, but since roughly 50% of our score is based on payment habits and length of payment history, eliminating that history can dramatically reduce our score over time.

Plus, since another 30% is based on the amount we owe compared to our total credit balance, eliminating cards with no balance will further reduce our scores. To boost your score, pay off the balances on those old cards, but keep them active by periodically charging a small amount on them and carrying a low balance for 30 to 60 days.

#3. All scoring models are the same — Just the opposite is true. Every lender, employer, etc., will use their preferred model…and there are hundreds of options. There are also modified scoring models used exclusively for credit cards, auto loans, mortgages, student loans, etc. Here are just a few of the leading models, along with their score ranges:

FICO Score: 300–850

FICO Score: 300–850- FICO Industry-Specific Scores: 250–900

- VantageScore 3.0: 300–850

- TransUnion Score: 501–990

- Equifax Score: 300–850

For an educational credit score at no cost, go to sites like Credit Karma, Quizzle, and Credit Sesame, but be prepared for ads, spam, and solicitations galore. Also, understand that these scores can differ from your actual score by as much as 50 points.

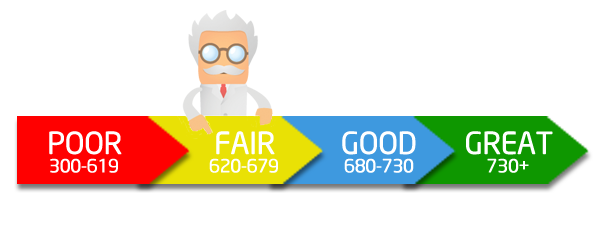

#4. My 660 is pretty good — This used to be a fairly good score, but today, lenders, employers, and others look for scores of 681 or higher. Some mortgage lenders will only approve those with scores of 800 or above. While everyone uses their own criteria to evaluate what constitutes a good score — and those numbers continue to rise — here are some broad averages: Excellent Credit 801–850; Good Credit 701–800; Fair Credit 601-700; Poor Credit 501-600; Bad Credit: Below 500.

#5. A “zero” score is a good thing — Many consumers have heard that a zero score is something to be proud of. If what they mean is that they have no debt, then yes, that’s excellent from a money-management perspective. However, because of how our credit score impacts our lives today (as covered in point #1), a zero score may prevent consumers of any age from successfully making financial transactions unless someone with a good credit score is willing to co-sign for them, or their transactions may simply cost more.

#6. Paying off a negative record is the best way to improve my score — Actually, reducing more current debts, avoiding opening new accounts, and continuing to make on-time payments will have a greater positive impact on your credit score. Those old collections or liens will continue to remain on your credit score for up to seven years, whether they are paid in full or not.

Evaluating and creating predictive creditworthiness is a continually evolving process. Each of the sites noted here can provide more background on the dramatic impact your credit scores can have on your financial life, along with ways to improve them under their specific scoring model.