The business structure you use – sole proprietor, LLC, etc. – has tremendous impact on how your company operates and pays taxes.

A business structure is simply an organizational framework. The IRS requires you to select one for your company, since this designation will determine the tax forms you’ll file as well as who is responsible for the company’s liabilities and debts. If you’ve already formed a company and have been operating as one of these structures, you should occasionally re-evaluate your status, especially if you’re growing and/or adding to your organizational structure.

A business structure is simply an organizational framework. The IRS requires you to select one for your company, since this designation will determine the tax forms you’ll file as well as who is responsible for the company’s liabilities and debts. If you’ve already formed a company and have been operating as one of these structures, you should occasionally re-evaluate your status, especially if you’re growing and/or adding to your organizational structure.

Here are the most common business structures and some of their attributes:

Sole Proprietorship

Whether you’re selling handmade items on Etsy or working solo in a profession like law or real estate, you’re most likely a sole proprietor (though you have other options). While you may have taken this route so you could be your own boss, there are drawbacks, including the fact that you are 100 percent responsible for your company’s liabilities. You may also find it difficult to get financing.

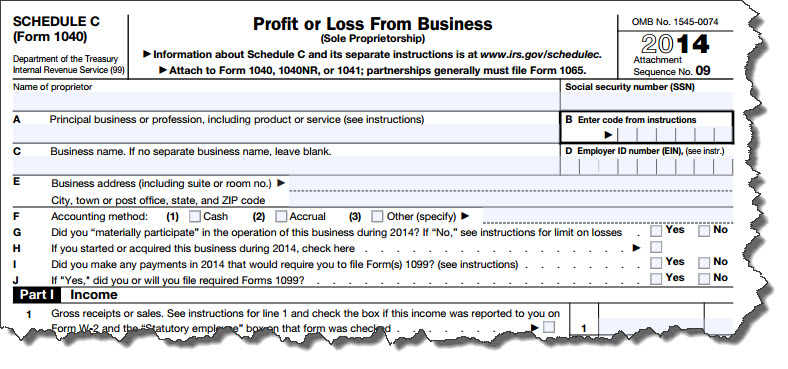

Figure 1: If this IRS form looks familiar and you don’t have any employees or partners, you’re most likely a sole proprietor.

The IRS defines a sole proprietor as “someone who owns an unincorporated business by himself or herself.” If you fit this definition, and you netted more than $400 as a self-employed person, you’re required to file a Schedule C with your Form 1040 that outlines your income and expenses. Since you are your own employer, you must pay Self-Employment Tax, the Medicare and Social Security taxes that employers pay for W-2 employees, as well as quarterly estimated taxes.

Note: Even if you have an employer who issues you a W-2 form, you must still complete a Schedule C for any side businesses you have.

Limited Liability Company (LLC)

Individuals (and other business entities) can also structure themselves as LLCs. The regulations for these vary by state, and tax obligations are a little more complex than for a sole proprietorship. We can help you decide if this is a good choice for you.

C Corporations

Businesses that choose this structure are generally larger companies with many employees. Since the company functions as a separate legal entity, no individuals are subject to personal liability. They file the IRS Form 1120 (among other documents) instead of a 1040, and they can sell stock in the company to raise revenue.

Businesses that choose this structure are generally larger companies with many employees. Since the company functions as a separate legal entity, no individuals are subject to personal liability. They file the IRS Form 1120 (among other documents) instead of a 1040, and they can sell stock in the company to raise revenue.

On the downside, C Corporations have complex administrative requirements. They must pay corporate tax, and their shareholders pay tax on dividends on their own returns.

Partnerships

Partnerships – and there are multiple types – are also very complex entities. They consist of two or more individuals who are not considered employees, but who are personally liable for the partnership’s debts and other obligations.

The partnership itself is not required to pay income tax like corporations do. Rather, they file a Form 1065 to report income, deductions, etc. Profits or losses are then “passed through” to the partners, who file Form 1040 as if they were sole proprietors, but who must attach a Schedule K-1 to the 1065.

You can see from this brief discussion that the business structure you select has enormous influence on your income tax obligations and your personal liability. Before you make a decision, or if you’re considering changing an existing structure, let us walk you through all of the possible implications for your company.

For more assistance on which business structure you should use or general questions, contact us!