According to ConsumerAffairs.com, student loan debt in American has surpassed $1.2 trillion, and has surged 84% since the Great Recession, with more than 40 million consumers having at least one student loan. This article also highlights the importance of financial education…especially on one of the most confusing solutions: federal student loan repayment options. Here we’ll provide some basics every federal student loan borrower needs to know, as well as the features and drawbacks of each of the repayment alternatives. But first, let’s consider the benefits and drawbacks of a loan consolidation.

According to ConsumerAffairs.com, student loan debt in American has surpassed $1.2 trillion, and has surged 84% since the Great Recession, with more than 40 million consumers having at least one student loan. This article also highlights the importance of financial education…especially on one of the most confusing solutions: federal student loan repayment options. Here we’ll provide some basics every federal student loan borrower needs to know, as well as the features and drawbacks of each of the repayment alternatives. But first, let’s consider the benefits and drawbacks of a loan consolidation.

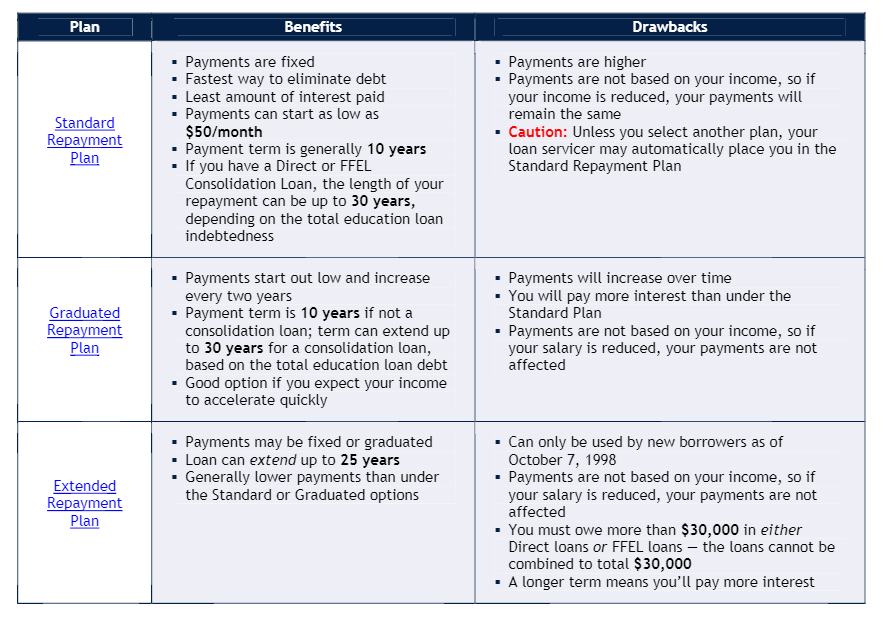

Step 1: Evaluate a Loan Consolidation

The Consumer Financial Protection Bureau (CFPB) warns borrowers to beware of student loan “debt relief” companies who charge illegal up-front fees and make false claims about reducing or eliminating student loan debt. After paying thousands of dollars, most borrowers found these companies either did nothing, or that they simply consolidated their student loan debt.

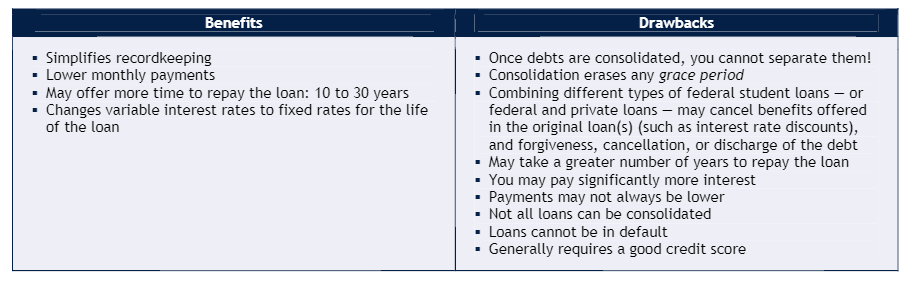

You can work directly with your service provider to consolidate debt — at no cost! Simply go to StudentAid.gov: Loan Consolidation to learn more. This solution is not for everyone, so consider the following benefits and drawbacks carefully prior to making this important decision:

Step 2: Review Payment Calculations

To help you decide which repayment plan you are eligible for, and to view a comparison of estimated monthly payments, go to the Department of Education’s Repayment Estimator. Remember, this only includes federal student loans, not private student loans.

Step 3: Select Your Repayment Plan

Repayment plans fall into two categories: those who do — and those who do not— qualify for Income-Driven Plans, which are generally based on income, family size, or some type of financial hardship.

Step 3a: Federal Repayment Plans — Non-Income-Driven Plans

Here are the loan repayment options for those who do not meet the criteria for the Income-Driven Plans:

The Standard Repayment Plan is obviously the best in terms of eliminating the debt for those who can afford it. However, in today’s economy and with millions of graduates making less income than anticipated upon graduation, this option, as well as the Graduated and Extended Plans, may not work.

Step 3b: Federal Repayment Plans — Income-Driven Plans

The Federal Reserve reports that11% of America’s 43 million student loan borrowers are in default, and that a shocking 11 million have missed at least one payment. It’s vitally important to avoid this problem, yet as many as 14 million borrowers owing less than $5,000 have allowed their loans to go into default. The leading reason for this is that these borrowers don’t feel they can afford the payments, which may be untrue since payments can be very low, even as low as $0/month!

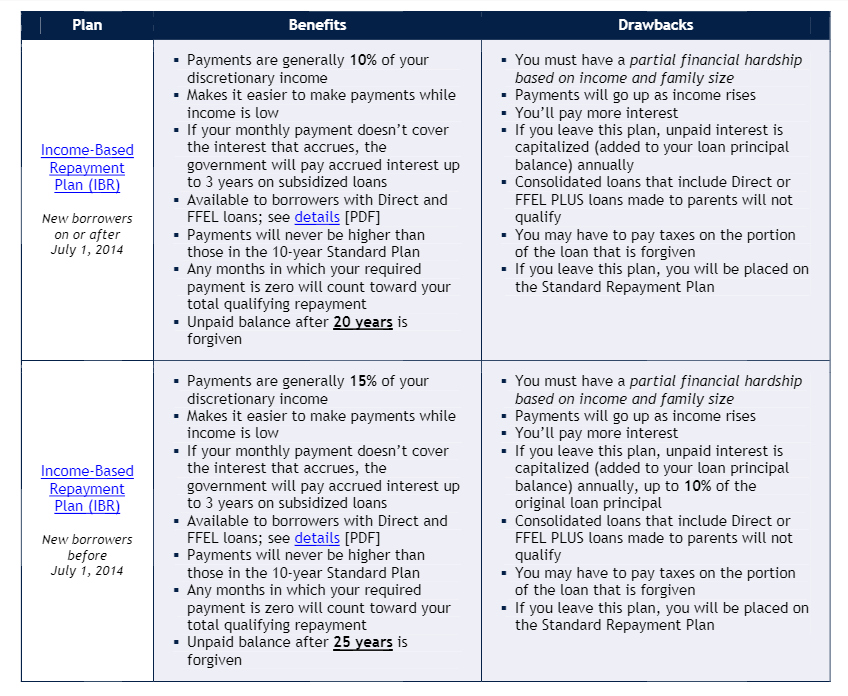

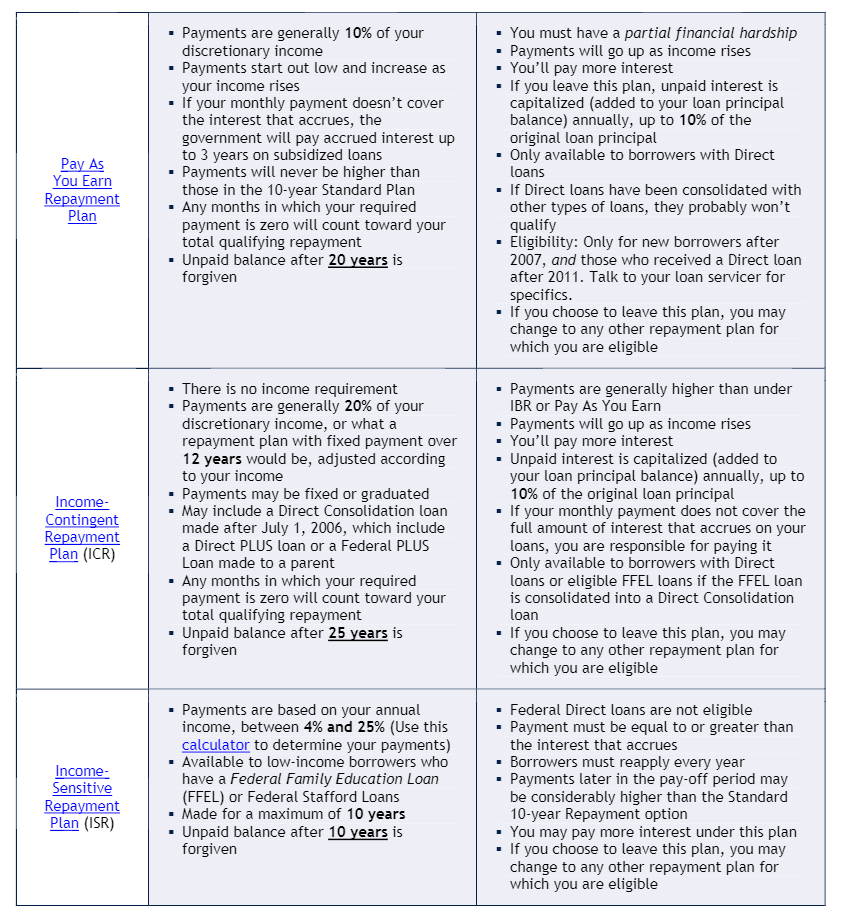

Here we’ll cover some of the new programs — often called Income-Driven Plans — available to those struggling to repay student loans. If your outstanding federal student loan debt is higher than your annual income, or if it represents a significant portion of your annual income, the following income-driven repayment plans may work for you. Payments are based on income and family size.

IBR and Pay As You Earn Plans require a partial financial hardship (see Income-Driven Plans: Eligibility). Private student loan debt is not counted for purposes of determining eligibility. ICR or ISR Plans are simply based on income. You may switch between plans at any time as long as you qualify.

Caution: It’s critical to take action before the loans are considered in default since that status will disqualify borrowers from most of the following programs. A student loan is considered to be in default when the borrower fails to make a payment for 270 days for federal loans, or 120 days for most private student loans.

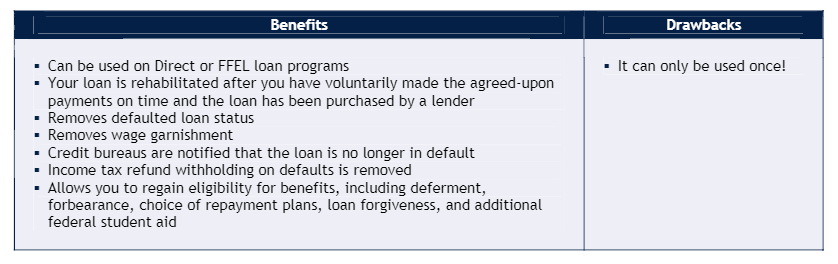

Loan Rehabilitation

If your loans have already gone into default, loan rehabilitation is an effective solution to help bring your loan status out of default so that you can be eligible for one of the repayment plans below. Here are the benefits and the one drawback of loan rehabilitation:

Income-Driven Plans

For more information, see Income-Driven Plans: Frequently Asked Questions [PDF]. Also, for an estimate of what your payments should be based on your family size, go to Income-Driven Plans: Repayment

Remember, there are additional exceptions and qualifiers other than those noted here.

If you have questions or are not sure whether your loans qualify for these repayment options, contact your loan servicer; however, the more you know before you contact them, the better prepared you’ll be to select the right option. If you’re not sure who your loan servicer is, visit the National Student Loan Data System (NSLDS) to find out.

We hope this has helped answer your questions on the wide variety of options available as you begin to repay your student loans.