The world of investing is often confusing to those planning for retirement…no matter their age or income level. A survey by TIAA- CREF reports an increasing number of Americans are unfamiliar with the investment options in their retirement plan. Our Investment Basics series is designed to de-mystify the terminology — covered in our “Investment Basics: Learn the Lingo” — and fill the knowledge gaps to build the confidence to ask the right questions and work with an advisor to select the best choices.

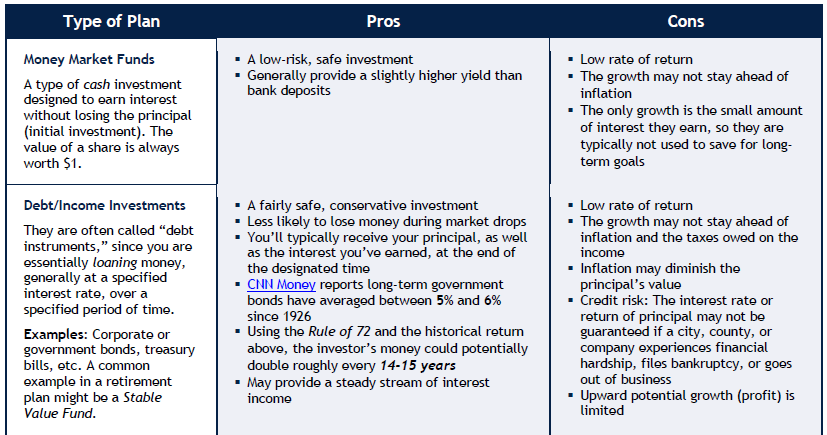

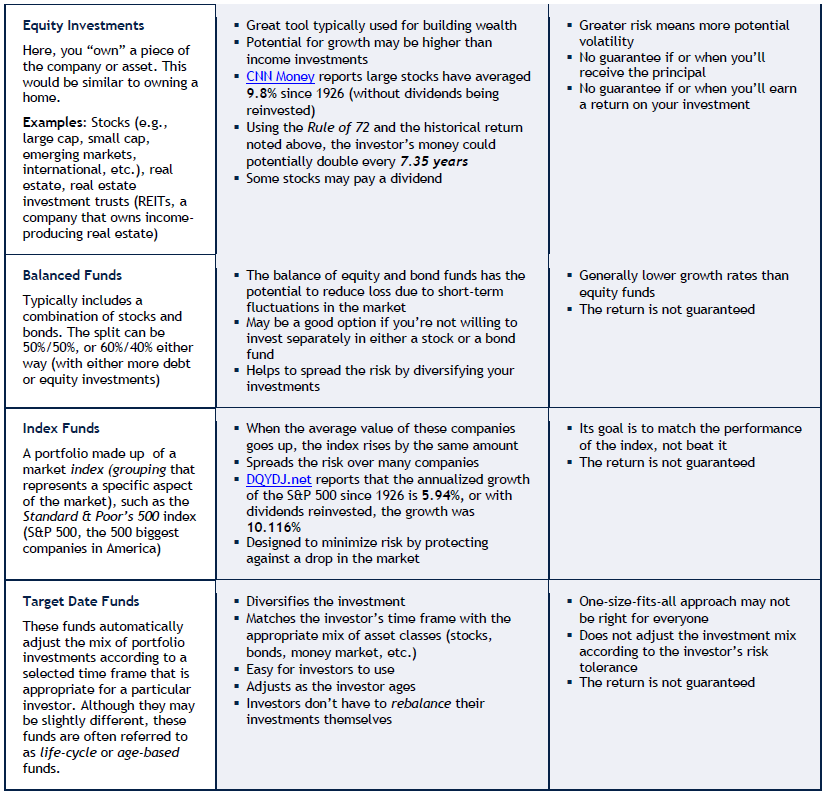

While there are thousands of investment products available, you’ll find just a few of the more common possibilities — or options — available in many retirement plans today listed below. If you see any terms below you don’t understand, go back to the “Learn the Lingo” issue for clarification.

While there are thousands of investment products available, you’ll find just a few of the more common possibilities — or options — available in many retirement plans today listed below. If you see any terms below you don’t understand, go back to the “Learn the Lingo” issue for clarification.

Mutual Funds — While every retirement plan is different, most of the options other than company stock are some type of mutual fund. A mutual fund is a pool of investments collected from multiple investors for the purpose of investing in securities. They give small investors access to professionally managed, diversified portfolios, which helps to spread the risk. Each fund has a specific purpose (cash, growth, income, target-date, etc.), which is outlined in the prospectus, a document that also details historical returns, investments included in the fund, and more.

Keep in mind, the explanations below are broad generalizations, and every fund’s gains and losses are determined by the selection of products within that fund. There may be additional pros and cons for each product type when invested outside of your retirement plan at work. Talk with your advisor to learn more.

This overview is not intended to provide advice on the best options for your unique situation, goals, and time frame. Use it to formulate questions to discuss with your benefit provider or advisor.

For more detailed information on these and other investment options, go to Investor.gov, SEC.gov, FINRA.org, or NASAA.org. Watch for more topics in our Investment Basics series in the future.